Hello and welcome back to today’s post, dear beginner trader.

In today’s post, I would like to share with you a few additional things to look out for, which I noticed need to be reaffirmed in connection with my first post, Who is a financial market broker?

This post will shed more light on what you need to look out for as a beginner trader when choosing a forex market broker if you want to succeed.

So, let’s get started.

Do you know that when it comes to retail forex trading, beginner traders often tend to focus on the advertising hype created by the forex broker rather than the important factors relating to their specific trading strategy?

Like a game of chess, all of the pieces should be taken into consideration before making a move.

Sooner rather than later, traders end up realizing that when it comes to long term trading, more factors should be considered when choosing a brokerage.

Attesting to this fact are the numerous complaints by traders on various forums about how their forex brokers don’t quite meet their expectations.

It all comes down to the traders doing their homework beforehand.

In this article, we will look at some of the most important factors that traders should look into when choosing where to trade.

BROKER’S CHOICE OF INSTRUMENTS:

While forex or currencies remain the most popular instruments, not all traders are the same.

Some prefer to trade stock CFDs, futures, or precious metals.

The first step for the trader is to identify the instruments that they prefer to trade.

This might not be based just on the preference of instruments but also can be handy when it comes to hedging exposure for a forex order against another asset or instrument.

A forex broker that offers a wide range of trading instruments is usually better, but for the most part, this eventually comes down to the trader in question.

Generally, if a brokerage can offer a vast range of financial instruments, it is a clear indication that they have access to several different markets and have therefore gone through numerous authentication procedures with liquidity providers to get price feeds for all the different instruments.

Overall, this should show a trader how much a company is willing to invest into its product offering to satisfy its clients.

BROKER’S SPREADS AND TRADING CONDITIONS:

Once you have identified a few brokers who offer the trading instruments that you prefer to trade, the next step is to compare the spreads and trading conditions.

When it comes to trading conditions, traders should focus on aspects such as overnight swaps that are charged, as well as the commissions and spreads from the broker.

Most traders tend to ignore these factors, but cost plays a big role if you want to be serious about trading.

It’s not going to be beneficial to a trader’s overall performance if all of their analysis and success in trading is spent on expensive overnight swap charges.

Many websites allow you to compare the spreads and trading conditions from different brokers.

However, it helps for traders to also look at brokers individually and to make a personal assessment to suit their trading requirements.

BROKER’S BANKING– DEPOSITS AND WITHDRAWALS:

After you have managed to nail the first two aspects, the next step is to look at the banking conditions.

It is common knowledge that forex brokers have different fees.

Therefore, the first step is to look at your most preferred method of deposit and withdrawal and to focus on the fees that the forex broker will charge.

Some forex brokers tend to waive the fees for first time customers.

However, traders should note that this can be a trap, and soon enough the fees can be larger than expected.

At this stage, most traders would benefit from finding a broker who allows free deposits and withdrawals no matter how long you have been with the brokerage.

BROKER’S REGULATION STATUS:

Regulation is an important aspect when it comes to selecting a forex market broker.

Ideally, it helps to trade with a forex broker who is regulated in your country of residence.

However, this is not always possible.

There are some regulatory bodies that are more widely recognized globally, such as the Cyprus Securities and Exchange Commission (CySEC) located in Cyprus or the Financial Conduct Authority (FCA) in the UK.

For the most part, trading with a regulated forex broker offers some kind of assurance that the forex broker won’t simply disappear and take your funds along with them.

Most of the regulated forex brokers offer a custodian banking service with segregated accounts.

This helps to keep the trader’s funds separate from the broker’s operating capital and can allow you to recover your funds in case the forex broker goes bust.

In certain jurisdictions, such as in Cyprus and the UK, this is a legal requirement.

BROKER’S SUPPORT SYSTEM:

With all of the above factors in place, maintenance of your trading is paramount… which is where a great support system is needed.

No matter how good the conditions, how low the spreads are, or how fast the execution is, without good support from the broker, trading could be impossible.

The support offered to the traders from a broker is often overlooked until a trader reaches a point where they need urgent help.

Always make sure that when you register with a broker, you have an account manager who you can reach, and a point of contact should you be experiencing technical issues.

Remember, 24/5 support should be standard with additional support tools such as learning material and tutorials to enhance your trading abilities.

Besides the above factors, there are also several other things that traders need to focus on.

However, this is very subjective and depends on one trader to another.

In conclusion, the bottom line remains that traders need to do their due diligence when it comes to choosing a forex broker.

Every trader is unique, and their trading preferences can vary.

SO, WHY CHOOSE THE METATRADER 5 TRADING PLATFORM?

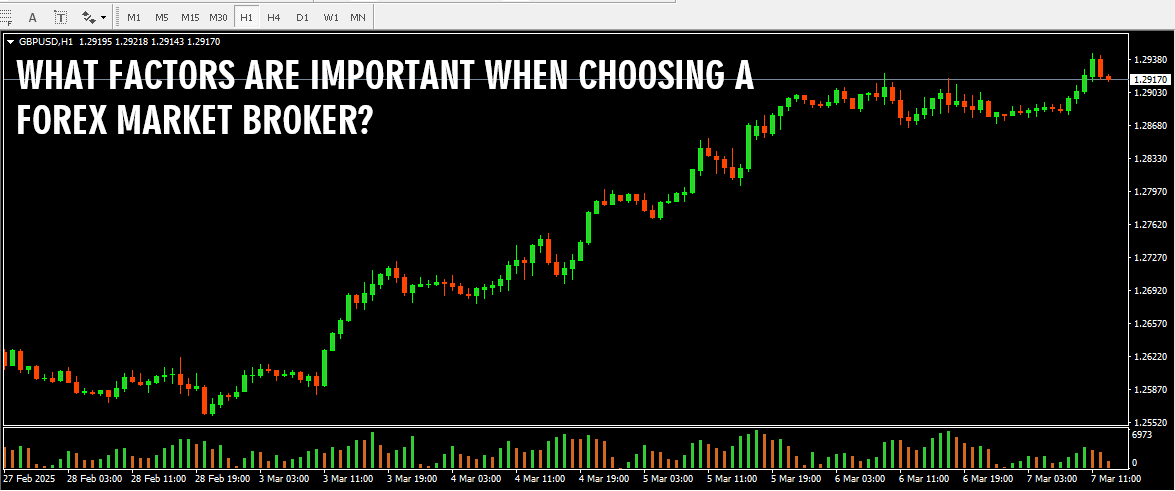

Personally, as a forex market trader, I enjoy trading with the MT4 platform because that was the first trading platform that got me started over the years while as a beginner, but due to innovation in recent times, most successful traders from around the world have chosen the MetaTrader 5 (MT5) platform for trading Forex, exchange instruments, futures, and CFDs.

MetaTrader 5 is an effective, multi-functional platform that provides everything you need to trade the financial markets.

The MT5 platform can be used by advanced traders as well as beginners since it can be expanded to incorporate additional programs and instruments.

The platform offers advanced financial trading functions as well as superior tools for technical and fundamental analysis.

MetaTrader 5 can also trade automatically by using trading robots and trading signals.

It is a trading platform that is capable of processing different financial instruments with a wide range of trading activity.

Traders may use a wide selection of pre-installed technical indicators and graphical objects to analyse the markets.

The MetaTrader 5 trading system offers an advanced Market Depth feature (with a tick chart and Time and Sales information), a separate accounting of orders and trades, and the support of all types of trading orders and execution modes.

It also allows you to chart assets at 21 different time frames and gives you the ability to have up to 100 charts open at any given time.

With the One Click Trading function and the Market Depth option, users can buy and sell currency pairs, equities, futures, and CFDs with just one click.

More advantages of MT5 include a user-friendly interface, larger icons, and a wider range of timeframes.

The MetaTrader 5 web platform allows you to start trading from any browser and operating system.

You can analyze quotes of financial instruments, perform trading operations, and access the history of your trades from any computer or laptop powered by Windows, Mac, iOS, or Linux.

In addition to high flexibility, the web trading platform offers maximum data protection, as all transmitted information is securely encrypted.

The web platform also supports an additional enhanced protection method through the use of two-factor authentication.

MetaTrader 5 is the best choice for the modern trader, as successful trading begins with a powerful and multi-functional trading platform.

There you have it, the few additional things to look out for as a beginner trader when choosing a forex market broker, if you want to succeed, especially with my recommended forex market broker, foreign exchange trading platform.

Congratulations, as you plan and make every right effort to succeed as a financial market trader

Based on its beginner friendly and profitable user experience as a trader, here is my recommended technical indicator for you as a beginner today (Band Single Indicator).

Also, to join other beginners in my recommended ongoing 14-day Career Freedom Opportunity, click here

P.S.: If you have any questions regarding this post, kindly go ahead and comment in the comment section below or share this post with your financial market trader friends using the share button on this post page. Thank you!

I want to see you succeed in life and in your financial market trading career.

Talk to you soon,

Daniel Ohuegbe,

14-Day Career Freedom Opportunity Founder And CashForex Trading System Creator!

14-Day Financial Market Success Mentor!

Dedicated To Redeeming Your Career And Financial Freedom!